nebraska sales tax rate by city

Blair in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Blair totaling 15. CountyCity Lottery Keno Frequently Asked Questions.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

There is no applicable county tax or special tax.

. L Local Sales Tax Rate. The Nebraska NE state sales tax rate is currently 55. The County sales tax rate is 0.

Sales Tax Rate Finder. The Nebraska sales tax rate is currently. Average Sales Tax With Local.

800-742-7474 NE and IA. This is the total of state county and city sales tax rates. There are no changes to local sales and use tax rates that are effective July 1 2022.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. 15 combined rate of 7.

Nebraska Sales Tax Table at 55 - Prices from 100 to 4780. The minimum combined 2022 sales tax rate for Nebraska City Nebraska is. For tax rates in other cities see Nebraska sales taxes by city and county.

Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit. Did South Dakota v. The Nebraska City Nebraska sales tax rate of 75 applies in the zip code 68410.

The 65 sales tax rate in Beaver City consists of 55 Nebraska state sales tax and 1 Beaver City tax. The Nebraska City Sales Tax is collected by the merchant on all qualifying sales made within Nebraska City. The Omaha sales tax rate is 15.

This is the total of state county and city sales tax rates. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. The Nebraska City sales tax rate is.

Click any locality for a full breakdown of local property taxes or visit our Nebraska sales tax calculatorto lookup local rates by zip code. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The Nebraska state sales and use tax rate is 55 055.

Registration fee for commercial truck and truck tractors is based. The Nebraska state sales and use tax rate is 55 055. The Nebraska sales tax rate is currently 55.

S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate. If you need access to a database of all Nebraska local sales tax rates visit the sales tax data page. Sales and Use Taxes.

The following sales and use tax rate changes will take effect in Nebraska on January 1 2017. Nebraska City 20 75 075 16-339 33705 Nehawka 10 65 065 240-340 33740 Neligh 10 65 065 91-341 33775 Nelson 10 65 065 80-342 33880 Newman Grove 15 70 07 98-346 34230 Niobrara 10 65 065 73-349 34370 Norfolk 15 70 07 15-351 34615 North Bend 15 70 07 92-353 34720. Simplify Nebraska sales tax compliance.

The minimum combined 2022 sales tax rate for Omaha Nebraska is 7. The Nebraska City Nebraska sales tax is 550 the same as the Nebraska state sales tax. Remember that zip code boundaries dont always match up with political boundaries like Nebraska City or Otoe County so you shouldnt always rely on something as imprecise as zip codes to.

Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality.

New local sales and use tax. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Sr Special Sales Tax Rate. Sales Tax Rate s c l sr. Nebraska Department of Revenue.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. Nebraska Documentation Fees. 2 combined rate of 75 Weeping Water.

15 combined rate of 7 Wilber. The County sales tax rate is. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax.

FilePay Your Return. 15 combined rate of 7 Papillion. You can print a 65 sales tax table here.

Click here to get more information. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. There are no changes to local sales and use tax rates that are effective January 1 2022.

Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax. 800 524-1620 Nebraska State. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

Groceries are exempt from the Omaha and Nebraska state sales taxes. 536 rows Nebraska Sales Tax55. There are approximately 7021 people living in the Nebraska City area.

The state capitol Omaha has a. 15 combined rate of 7 Local sales and use tax rate increase.

Nebraska Sales Tax Small Business Guide Truic

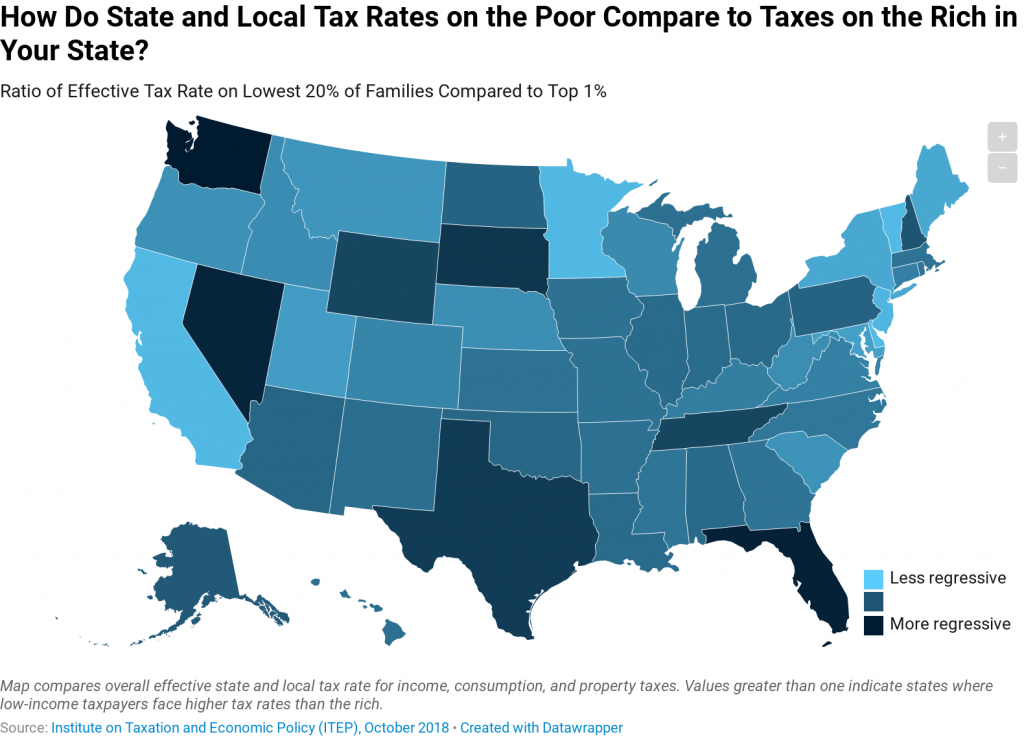

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Lev Business Tax Income Tax Cost Of Goods Sold

Nebraska Sales Tax Rates By City County 2022

How Is Tax Liability Calculated Common Tax Questions Answered

States With The Highest And Lowest Property Taxes Property Tax States High Low

Us States With The Highest And Lowest Per Capita State Income Taxes Map American History Timeline Mapping Software

State And Local Sales Taxes In 2012 Tax Foundation

Updated State And Local Option Sales Tax Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Want To Avoid High Taxes Retire In One Of These 10 States Retirement Tax Money Choices

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map