san antonio sales tax rate 2021

California City County Sales Use Tax Rates effective April 1 2022. As of January 1 2021.

Understanding California S Sales Tax

Bexar County Texas Sales Tax Rate 2021 - Avalara Bexar County Texas sales tax rate Home Texas Bexar County Bexar County Tax jurisdiction breakdown for 2022 Texas 625 San Antonio 125 San Antonio Atd Transit 025 San Antonio Mta Transit 05 Minimum combined sales tax rate value 825.

. 2 P age. 2020 Official Tax Rates Exemptions. Click here to get more information.

There is no applicable county tax. 2021 Official Tax Rates Exemptions Name Code. City Rate County Angels.

290 45 482 772 16 830. Texas Sales Tax. 1 2022 Current Sales Tax Rates TXT Historical Tax Rate Files 2022.

With local taxes the total sales tax rate is between 6250 and 8250. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. The unemployment rate in San Antonio peaked in April 2020 at 138 and is now 92 percentage points lower.

6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax. California City and County Sales and Use Tax Rates. Texas TX Sales Tax Rates by City The state sales tax rate in Texas is 6250.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. As of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

San Antonio collects the maximum legal local sales tax. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. Sales Tax Rates Quarter 2 TXT Sales Tax Rates Quarter 1 TXT.

Simplify Texas sales tax compliance. The December 2020. B 725 1 143 868 9 250 Colo.

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. San Antonio TX 78205 Phone. California City and County Sales and Use Tax Rates Rates Effective 0712021 through 09302021 1 P age.

Birmingham Alabama at 10 percent rounds out the list of. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio.

State Local Sales Tax Rates as of January 1 2021 State State Tax Rate Rank Avg. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. 625 percent of sales price minus any trade-in allowance.

State State Sales Tax. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. This is lower than the long-term average of 532.

You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables. Local Tax Rate a Combined Rate Rank Max Local Tax Rate Ala. Sales and Use Tax.

Five other citiesFremont Los Angeles and Oakland California. How Does Sales Tax in San Antonio compare to the rest of Texas. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

560 28 280 840 11 560 Ark. Select the Texas city from the list. 2021 State.

Rates Effective 0712021 through 09302021. Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent. 1000 City of San Antonio.

4 rows The current total local sales tax rate in San Antonio TX is 8250. San Lorenzo 10250 Alameda South Shore Alameda 10750. Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates.

As of November 2021 the unemployment rate in San Antonio-New Braunfels TX MSA is 46 compared to 47 the previous month and 65 last year. 0250 San Antonio ATD Advanced Transportation District. Tax rates are now 64-bit compatible.

Texas Sales Tax Table at 625 - Prices from 100 to 4780. The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate. These files are for use with the Comptrollers software for sales and use tax EDI software.

San Leandro 10750. 650 9 301 951 3 5125 Calif. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

To make matters worse rates in most major cities reach this limit. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Texas has recent rate changes Thu Jul 01 2021.

Most Recent as of Apr. 0125 dedicated to the City of San Antonio Ready to Work Program. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. 400 40 522 922 5 750 Alaska 000 46 176 176 46 750 Ariz. San Antonios current sales tax rate is 8250 and is distributed as follows.

2021 Official Tax Rates. The base state sales tax rate in Texas is 625. And Seattle Washingtonare tied for the second highest rate of 1025 percent.

0500 San Antonio MTA Metropolitan Transit Authority. 2021 Official Tax Rates Exemptions.

Understanding California S Sales Tax

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Understanding California S Sales Tax

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Sales Tax Guide And Calculator 2022 Taxjar

Pin On General Real Estate Information

Texas Sales Tax Rates By City County 2022

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Understanding California S Sales Tax

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Understanding California S Sales Tax

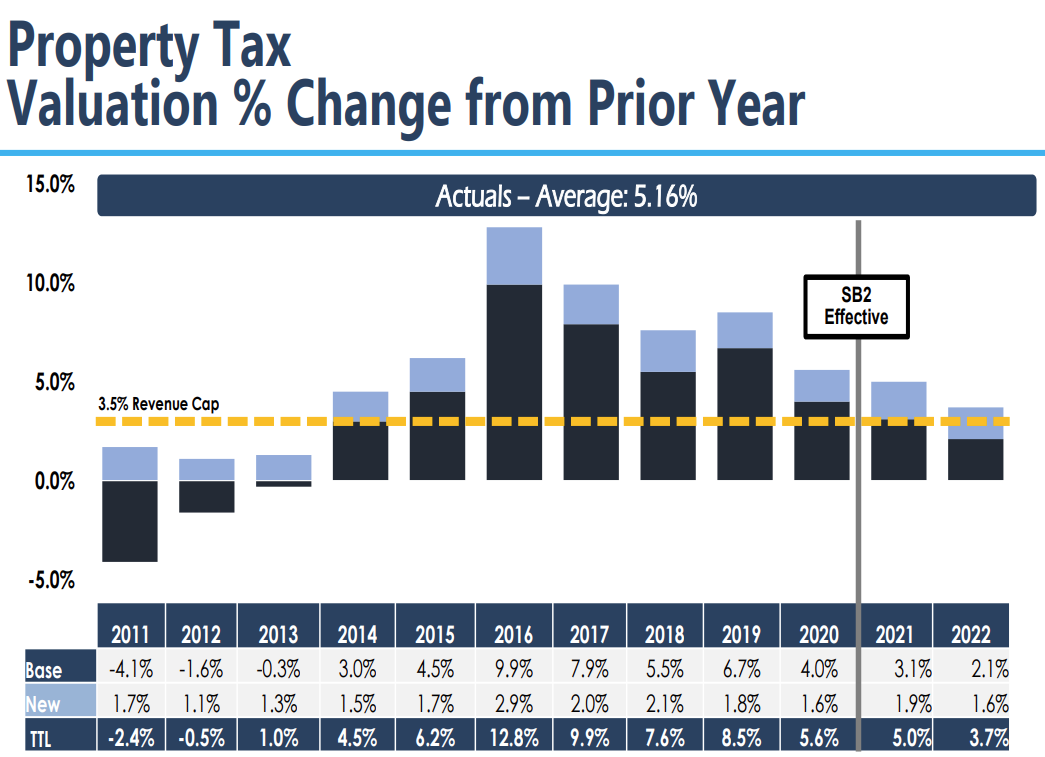

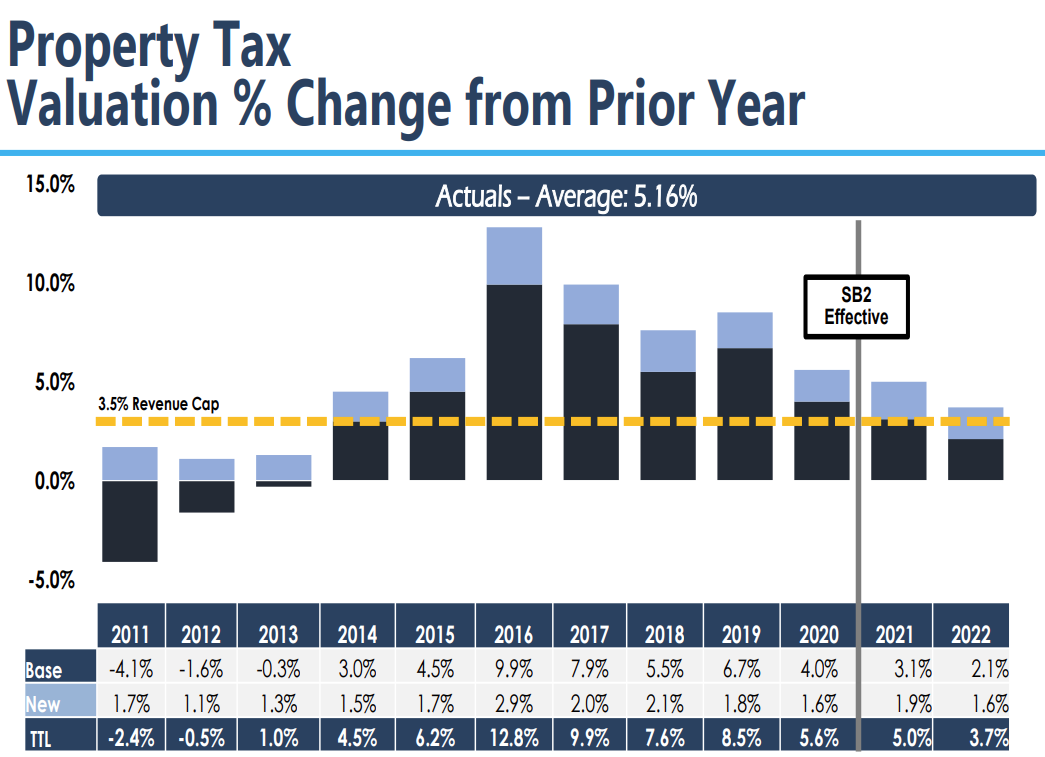

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Understanding California S Sales Tax

Texas Sales Tax Guide For Businesses

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25